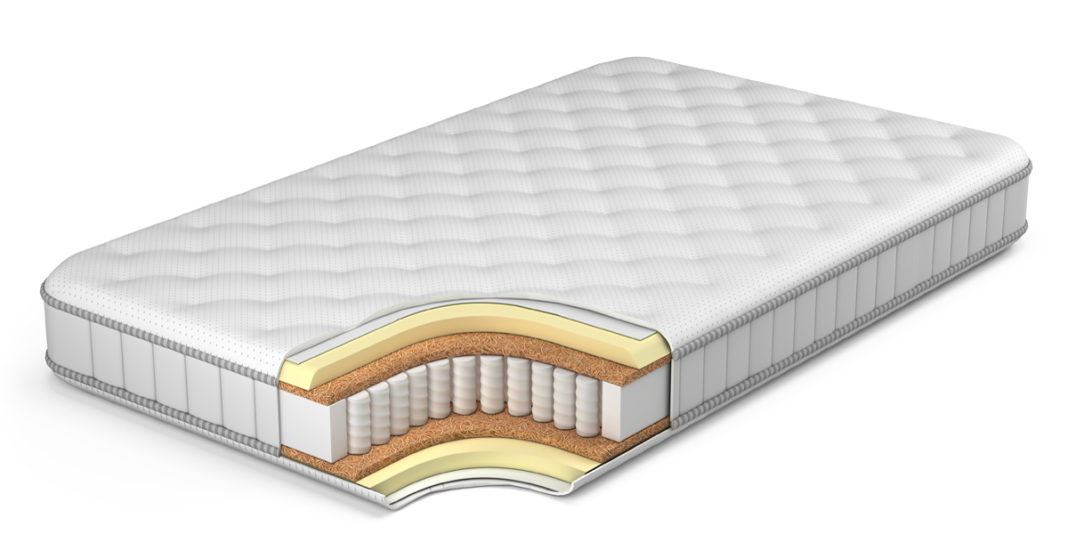

Replacing a mattress can be a significant expense, especially if you're dealing with a health condition that requires a specific type of mattress. The good news is that some insurance plans may cover the cost of a new mattress or provide partial coverage. If you're wondering if you can get a mattress through insurance, read on to learn more about the process and what you need to know.1. Mattress Replacement Through Insurance: What You Need to Know

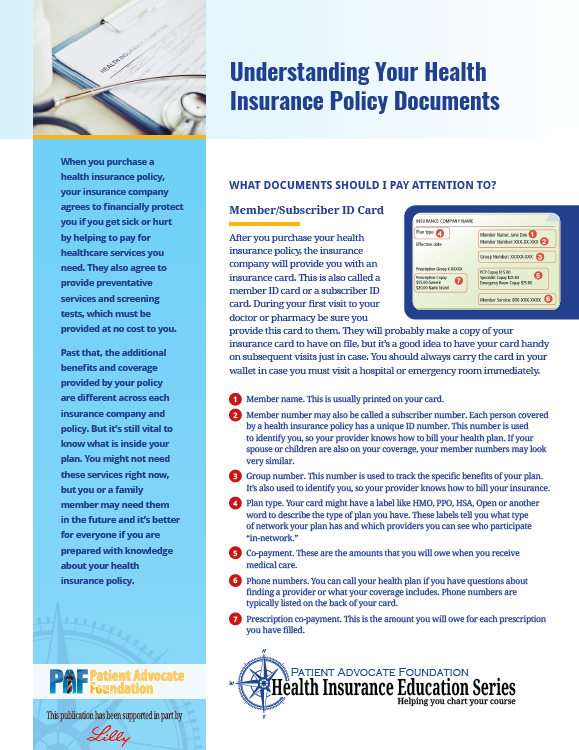

The answer to this question depends on your specific health insurance plan. Some plans may include coverage for durable medical equipment, which can include mattresses. However, this coverage may only be available for individuals with certain health conditions or injuries that require a specialized mattress. It's essential to check with your insurance provider to see if your plan includes coverage for a new mattress.2. Can You Get a New Mattress Through Your Health Insurance?

If your health insurance plan does cover a new mattress, there are certain steps you'll need to take to get it covered. First, you'll need to have a prescription from a doctor stating that you require a specialized mattress for your medical condition. This prescription will need to include specific details about the type of mattress needed and why it's necessary for your health. Once you have the prescription, you can submit it to your insurance provider for review.3. How to Get a Mattress Covered by Insurance

It's crucial to have a clear understanding of what your insurance plan covers before attempting to get a mattress through insurance. Some plans may only cover a specific amount or percentage of the cost, while others may require you to pay a deductible first. Additionally, your plan may only cover specific types of mattresses, so it's essential to review your plan's coverage details carefully.4. Understanding Insurance Coverage for Mattress Replacement

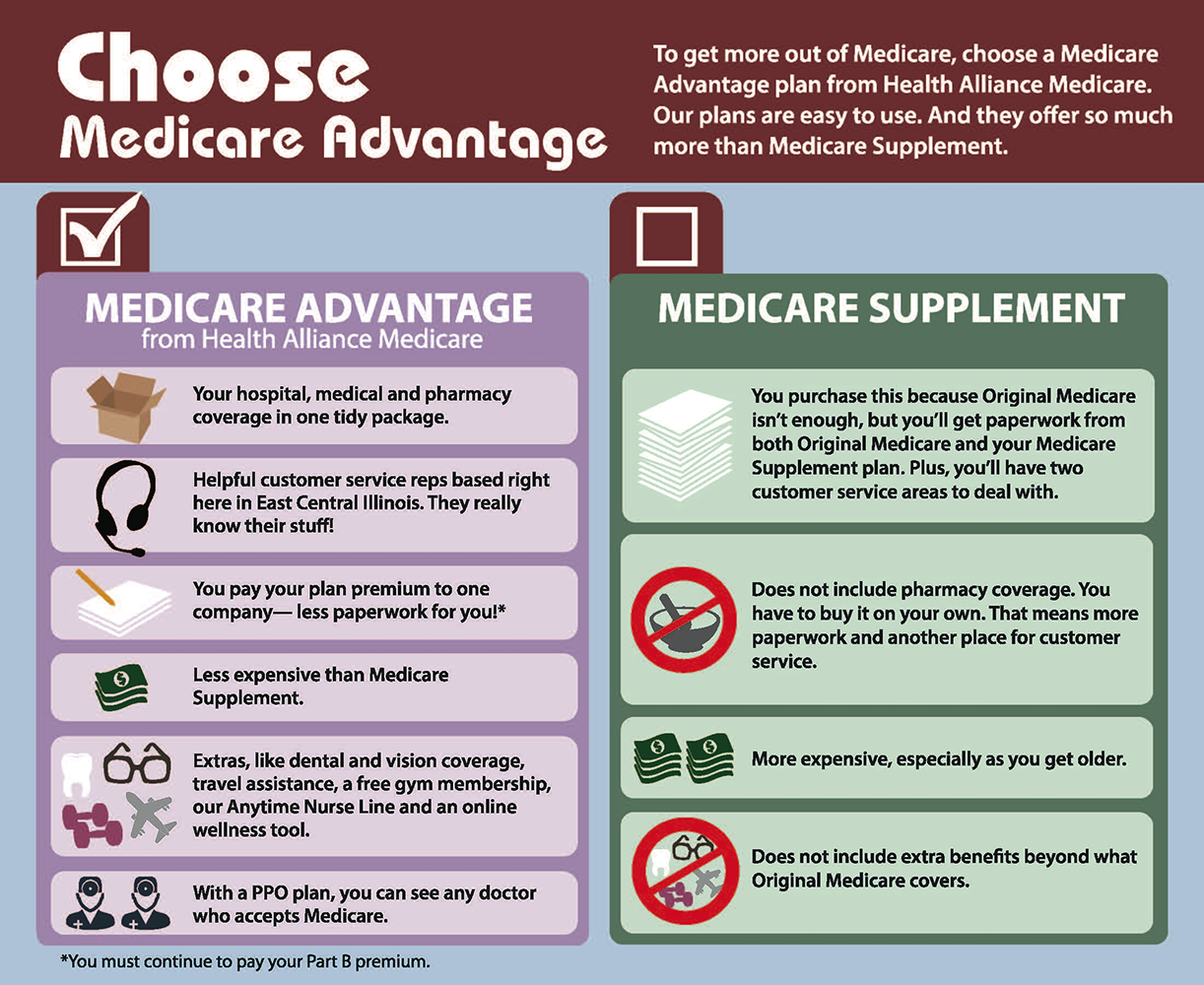

Medicare is a federal health insurance program for individuals aged 65 and older, as well as those with certain disabilities. While Medicare does cover some durable medical equipment, such as wheelchairs and hospital beds, it does not typically cover mattresses. However, some Medicare Advantage plans may offer coverage for a new mattress, so it's worth checking with your plan provider.5. Can You Get a Mattress Through Medicare?

The process of getting a mattress through insurance can vary depending on your provider and plan. In general, you'll need to follow these steps: Step 1: Get a prescription from your doctor for a specialized mattress. Step 2: Submit the prescription to your insurance provider for review. Step 3: Wait for approval and coverage details from your insurance provider. Step 4: Choose a mattress that meets your insurance plan's coverage guidelines. Step 5: Purchase the mattress and submit a claim for reimbursement if necessary.6. The Process of Getting a Mattress Through Insurance

While getting a mattress through insurance can be a lengthy and sometimes complicated process, there are a few tips that can help make it smoother: Tip 1: Always check with your insurance provider first to see if your plan includes coverage for a new mattress. Tip 2: Make sure your doctor's prescription contains all the necessary information and details about your medical condition and the need for a specialized mattress. Tip 3: Keep all your receipts and documentation throughout the process, in case you need to submit a claim for reimbursement. Tip 4: Be patient and persistent. It may take some time and back-and-forth communication with your insurance provider to get a mattress covered.7. Tips for Getting Your Mattress Covered by Insurance

The types of mattresses covered by insurance can vary depending on your specific plan's coverage guidelines. However, most insurance providers will only cover medically necessary mattresses, such as those designed to relieve pressure points or provide proper support for specific health conditions. It's essential to check with your insurance provider to see what types of mattresses they will cover.8. What Types of Mattresses Are Covered by Insurance?

If your insurance plan requires you to purchase the mattress first and then submit a claim for reimbursement, the process is relatively straightforward. You'll need to gather all your receipts and documentation, including your doctor's prescription, and submit them to your insurance provider according to their specific guidelines. Make sure to follow up with your provider if you don't receive a response or reimbursement within a reasonable timeframe.9. How to File a Claim for a Mattress Through Insurance

If your insurance plan doesn't cover a new mattress or you don't have insurance, there are still other ways to get a new mattress at a reduced cost. Some organizations and charities offer assistance programs for individuals in need of a specialized mattress. You can also consider purchasing a mattress from a company that offers financing options or discounts for those with medical needs. While getting a mattress through insurance may take some effort and patience, it can be a worthwhile option for individuals with specific health conditions. If you're in need of a new mattress, make sure to explore all your options and work closely with your insurance provider to determine the best course of action.10. Alternatives to Getting a Mattress Through Insurance

How to Get a Mattress Through Insurance

Exploring Your Options

If you are in need of a new mattress, you may be wondering if your insurance can cover the cost. The good news is that in some cases, insurance can help with the expense of purchasing a new mattress. However, it's important to understand the limitations and requirements for this type of coverage.

If you are in need of a new mattress, you may be wondering if your insurance can cover the cost. The good news is that in some cases, insurance can help with the expense of purchasing a new mattress. However, it's important to understand the limitations and requirements for this type of coverage.

Types of Insurance That May Cover a Mattress

There are a few types of insurance that may provide coverage for a new mattress. These include health insurance, homeowner's or renter's insurance, and worker's compensation. Each of these types of insurance has different requirements and limitations, so it's important to understand what your specific policy covers.

Health insurance:

In some cases, health insurance may cover the cost of a new mattress if it is deemed medically necessary. This may be the case if you have a medical condition that requires a specific type of mattress, such as a memory foam mattress for back pain.

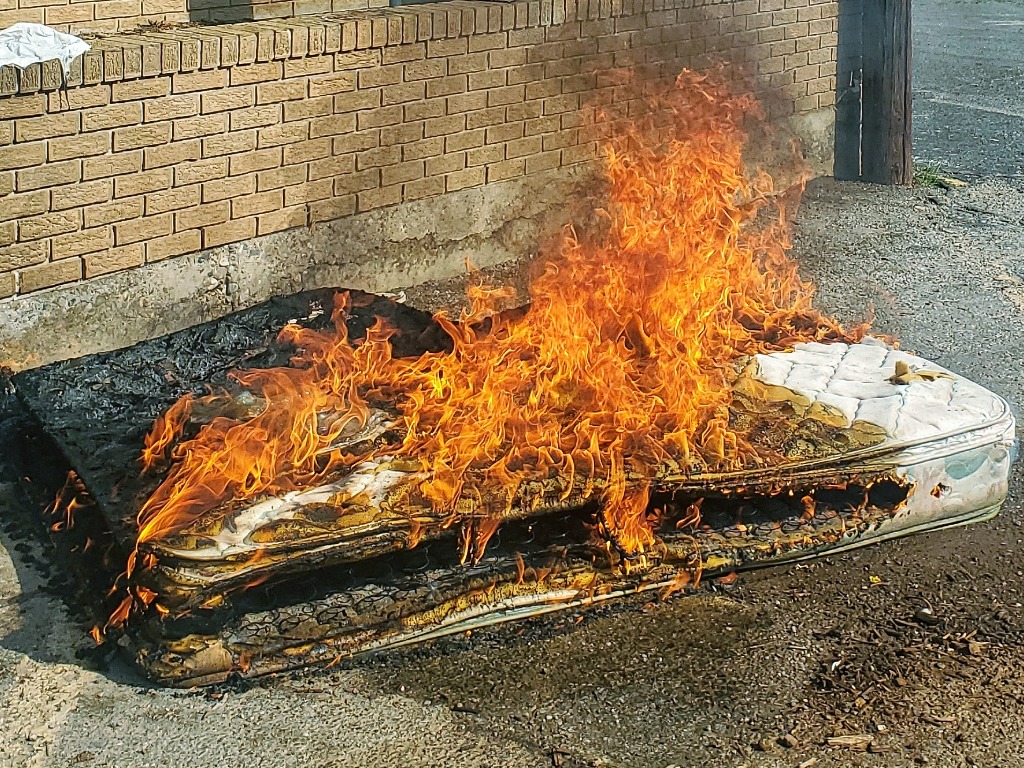

Homeowner's or renter's insurance:

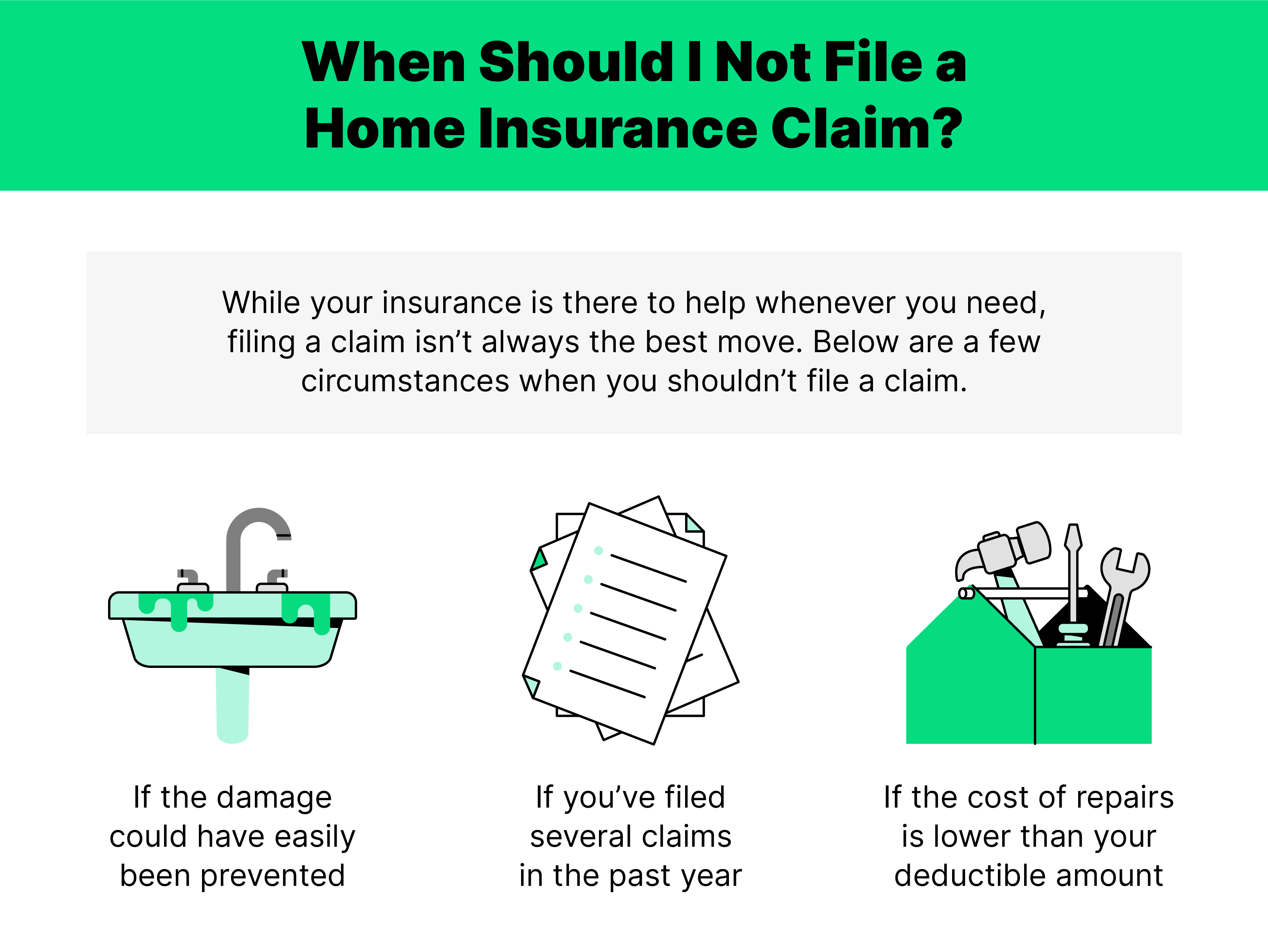

Your homeowner's or renter's insurance may cover the cost of a new mattress if it is damaged or destroyed due to a covered event, such as a fire or natural disaster. However, this coverage may only apply if the mattress was damaged in your home or apartment.

Worker's compensation:

If you have sustained a work-related injury or illness that requires a new mattress for medical reasons, worker's compensation insurance may cover the cost. This may include injuries that result from lifting heavy objects or prolonged sitting or standing.

There are a few types of insurance that may provide coverage for a new mattress. These include health insurance, homeowner's or renter's insurance, and worker's compensation. Each of these types of insurance has different requirements and limitations, so it's important to understand what your specific policy covers.

Health insurance:

In some cases, health insurance may cover the cost of a new mattress if it is deemed medically necessary. This may be the case if you have a medical condition that requires a specific type of mattress, such as a memory foam mattress for back pain.

Homeowner's or renter's insurance:

Your homeowner's or renter's insurance may cover the cost of a new mattress if it is damaged or destroyed due to a covered event, such as a fire or natural disaster. However, this coverage may only apply if the mattress was damaged in your home or apartment.

Worker's compensation:

If you have sustained a work-related injury or illness that requires a new mattress for medical reasons, worker's compensation insurance may cover the cost. This may include injuries that result from lifting heavy objects or prolonged sitting or standing.

Requirements for Coverage

In order for insurance to cover the cost of a new mattress, there are typically certain requirements that must be met. These may include a doctor's prescription stating that a new mattress is medically necessary, proof of damage to the mattress, or documentation from your employer for a worker's compensation claim.

It's also important to note that even if your insurance does cover the cost of a new mattress, there may be limitations on the type or brand of mattress that is covered. Make sure to check with your insurance provider to see what is included in your coverage.

In order for insurance to cover the cost of a new mattress, there are typically certain requirements that must be met. These may include a doctor's prescription stating that a new mattress is medically necessary, proof of damage to the mattress, or documentation from your employer for a worker's compensation claim.

It's also important to note that even if your insurance does cover the cost of a new mattress, there may be limitations on the type or brand of mattress that is covered. Make sure to check with your insurance provider to see what is included in your coverage.

How to File a Claim

If you believe your insurance may cover the cost of a new mattress, the first step is to contact your insurance provider and ask about their specific requirements and limitations. They will likely require documentation, such as a doctor's prescription or proof of damage, in order to process your claim.

Once you have all the necessary documentation, you can file a claim with your insurance provider. Make sure to follow their specific instructions and provide all required information.

If you believe your insurance may cover the cost of a new mattress, the first step is to contact your insurance provider and ask about their specific requirements and limitations. They will likely require documentation, such as a doctor's prescription or proof of damage, in order to process your claim.

Once you have all the necessary documentation, you can file a claim with your insurance provider. Make sure to follow their specific instructions and provide all required information.

In Conclusion

While insurance may be able to help with the cost of a new mattress, it's important to understand the limitations and requirements for coverage. Make sure to thoroughly research your insurance policy and speak with your provider to determine if you are eligible for coverage. With some careful planning and documentation, you may be able to get a new mattress through insurance.

While insurance may be able to help with the cost of a new mattress, it's important to understand the limitations and requirements for coverage. Make sure to thoroughly research your insurance policy and speak with your provider to determine if you are eligible for coverage. With some careful planning and documentation, you may be able to get a new mattress through insurance.