Donating to charitable organizations is not only a way to give back to the community, but it can also provide tax benefits. If you're looking to declutter your dining room or upgrade your furniture, donating your dining room chairs is a great way to do so while also potentially reducing your tax liability. The Internal Revenue Service (IRS) allows taxpayers to deduct the fair market value of donated items, including dining room chairs, on their tax returns. Let's take a closer look at how you can take advantage of this tax deduction.IRS Tax Deduction for Donating Dining Room Chairs

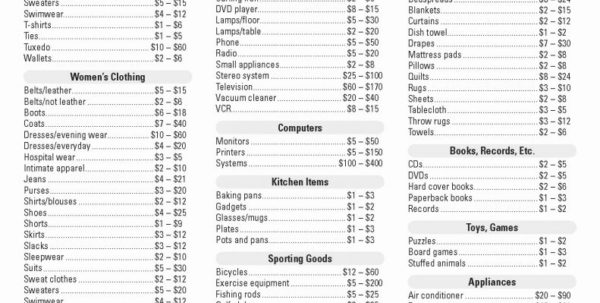

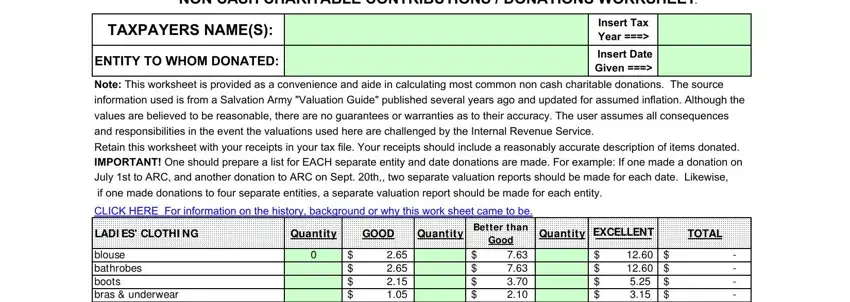

Before donating your dining room chairs, it's important to determine their fair market value for IRS purposes. Fair market value is the price that a willing buyer would pay and a willing seller would accept for the item. Keep in mind that this may not necessarily be the original purchase price or the current retail value of the chairs. You can use resources such as online marketplaces or thrift store prices to get an idea of the fair market value.How to Determine the Value of Donated Dining Room Chairs for IRS Purposes

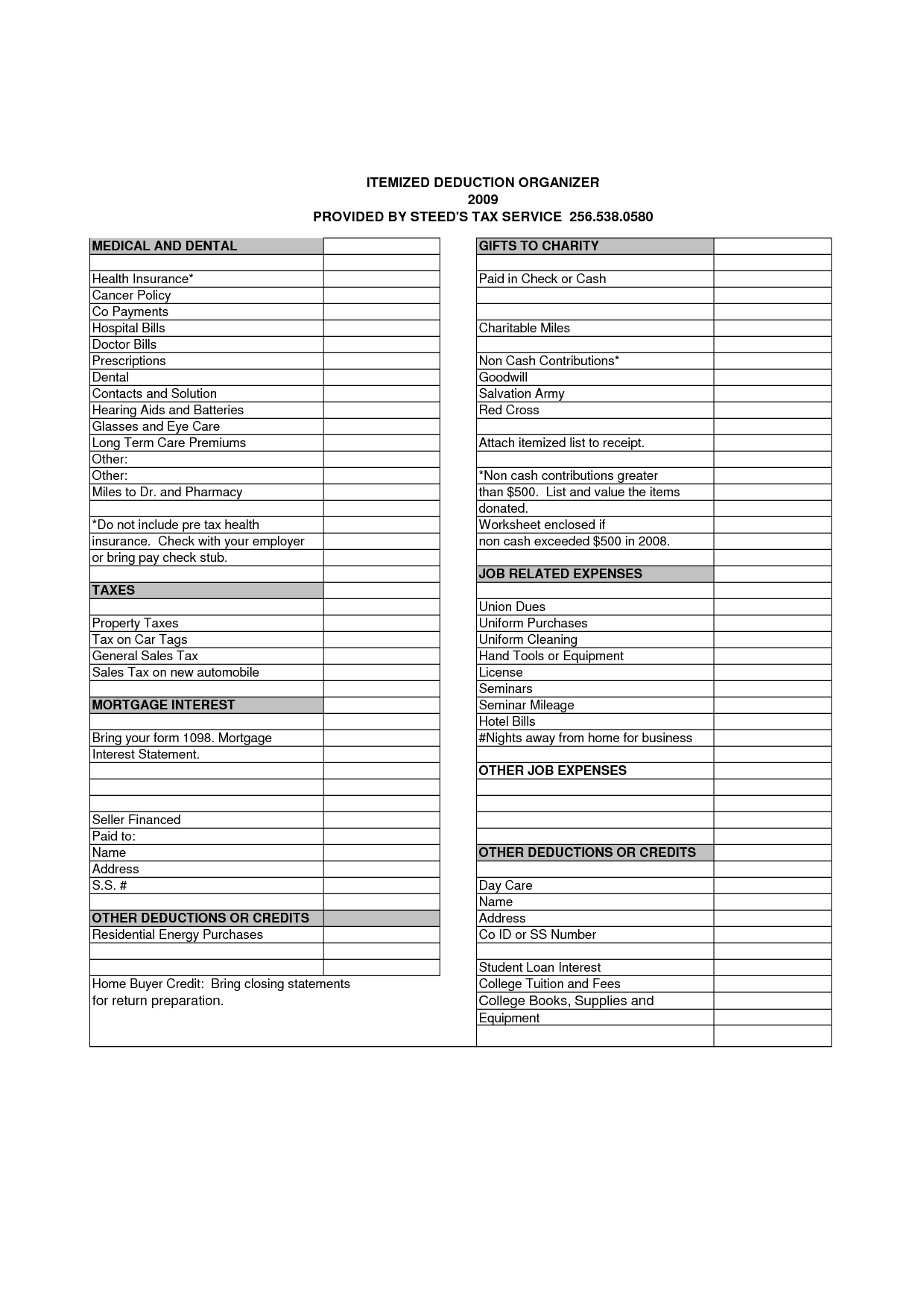

The IRS has specific guidelines for taxpayers who wish to claim a tax deduction for donated items. These guidelines include:IRS Guidelines for Donating Dining Room Chairs

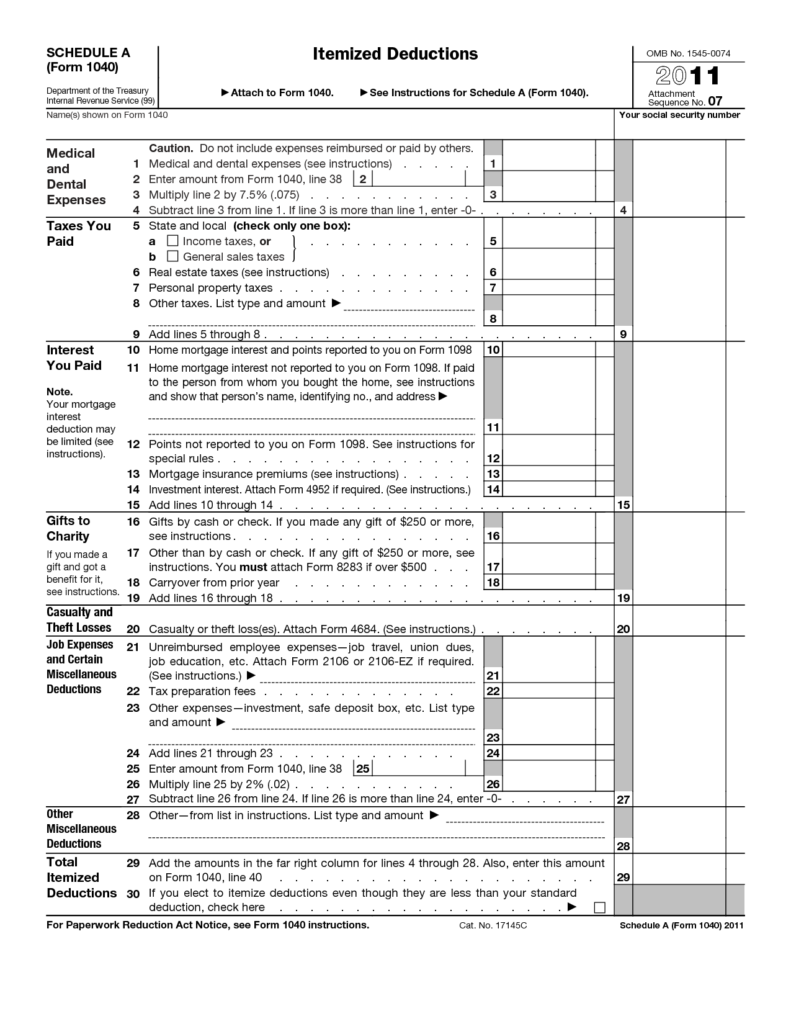

The amount of tax deduction you can claim for donated dining room chairs is based on their fair market value. If the total value of your non-cash donations for the year is less than $500, you can claim the actual fair market value of the items. However, if the total value exceeds $500, you will need to complete Section A of Form 8283 to determine the deduction amount. The deduction amount is also subject to certain limitations based on your income.Calculating the Tax Deduction for Donating Dining Room Chairs to the IRS

In addition to the guidelines mentioned above, the IRS has specific rules for donating dining room chairs that you should be aware of.IRS Rules for Donating Dining Room Chairs

If you want to maximize your tax benefits for donating dining room chairs to the IRS, there are a few things you can do:Maximizing Tax Benefits for Donating Dining Room Chairs to the IRS

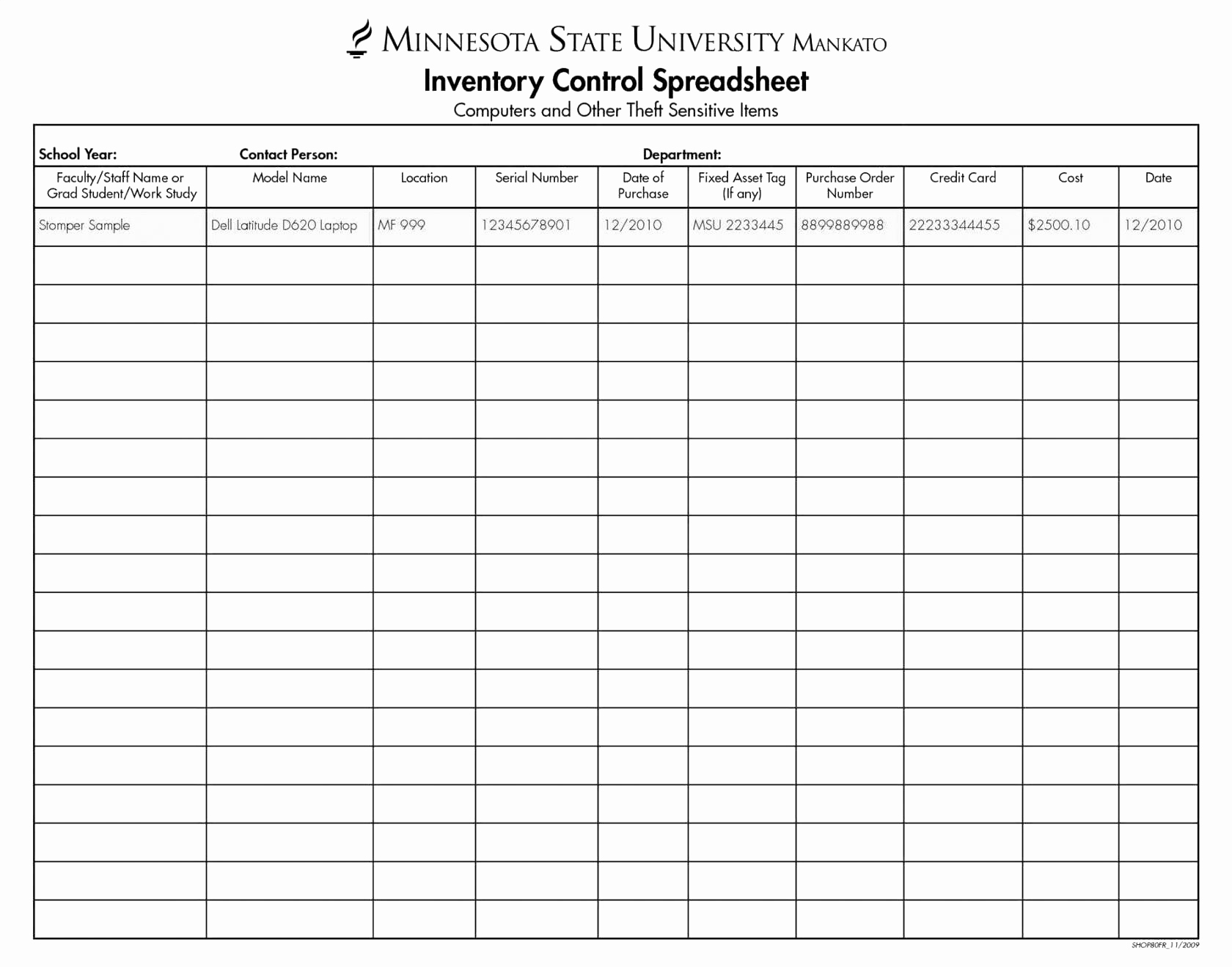

In addition to the guidelines and rules mentioned above, there are a few requirements that you must meet when donating dining room chairs to claim a tax deduction:IRS Requirements for Donating Dining Room Chairs

If you're planning to donate your dining room chairs for tax purposes, here are a few tips to help you maximize your tax deductions:Tips for Donating Dining Room Chairs to Maximize IRS Tax Deductions

As mentioned earlier, if the total value of your non-cash donations, including your dining room chairs, exceeds $500, you must file Form 8283 with your tax return. This form requires you to provide details about the donated items, including their fair market value and the organization you donated them to. You may also need to provide an appraisal if the total value of your donations exceeds $5,000.IRS Forms for Reporting Donated Dining Room Chairs

When it comes to tax deductions, it's important to be accurate and follow the rules to avoid any issues with the IRS. Here are some common mistakes to avoid when donating dining room chairs:Common Mistakes to Avoid When Donating Dining Room Chairs to the IRS

The Importance of Donating Dining Room Chairs for Tax Deductions

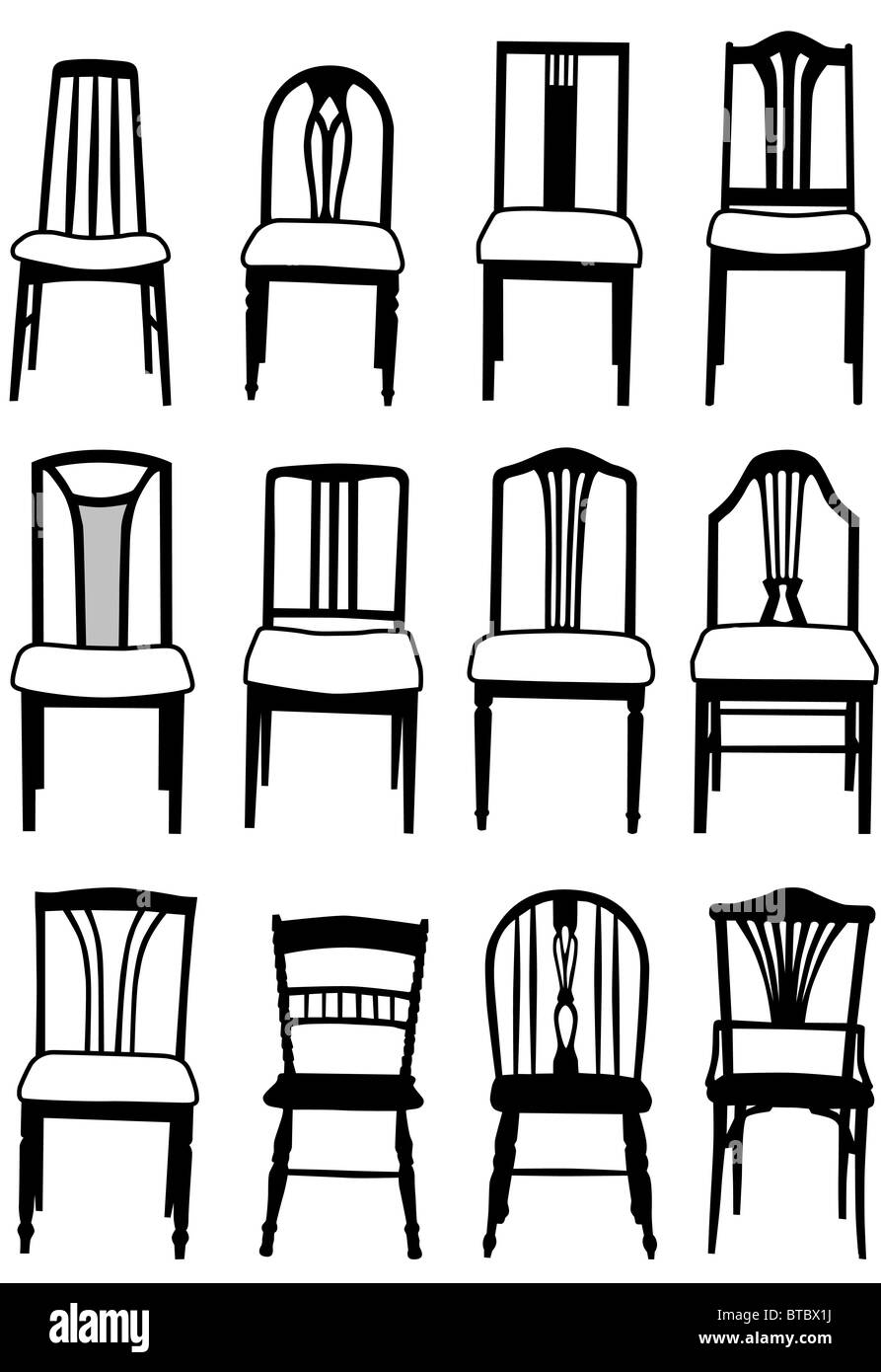

Dining Room Chairs: A Vital Piece of Furniture

When it comes to house design, the dining room is often considered the heart of the home. It is a space where family and friends gather to share meals, stories, and create lasting memories. And what better way to enhance this space than with a set of beautiful and functional dining room chairs? Not only do chairs provide comfort and support during meals, but they also add to the overall aesthetic of the room.

When it comes to house design, the dining room is often considered the heart of the home. It is a space where family and friends gather to share meals, stories, and create lasting memories. And what better way to enhance this space than with a set of beautiful and functional dining room chairs? Not only do chairs provide comfort and support during meals, but they also add to the overall aesthetic of the room.

The Benefits of Donating Dining Room Chairs

As with any piece of furniture, dining room chairs can start to show wear and tear over time. Perhaps your chairs no longer match your current design style, or you simply want to upgrade to a newer set. Instead of throwing them away or letting them collect dust in storage, consider donating them to a charitable organization.

Not only does donating your dining room chairs help someone in need, but it also comes with potential tax benefits. The Internal Revenue Service (IRS) allows taxpayers to claim tax deductions for charitable donations, including furniture. By donating your chairs, you can potentially lower your taxable income and save money on taxes.

As with any piece of furniture, dining room chairs can start to show wear and tear over time. Perhaps your chairs no longer match your current design style, or you simply want to upgrade to a newer set. Instead of throwing them away or letting them collect dust in storage, consider donating them to a charitable organization.

Not only does donating your dining room chairs help someone in need, but it also comes with potential tax benefits. The Internal Revenue Service (IRS) allows taxpayers to claim tax deductions for charitable donations, including furniture. By donating your chairs, you can potentially lower your taxable income and save money on taxes.

Maximizing Your Donation Value

To ensure that you receive the maximum tax deduction for your donation, it is important to properly value your dining room chairs. The IRS has specific guidelines for determining the fair market value of donated items, which takes into account factors such as the condition of the chairs, the original purchase price, and the current market value.

One way to determine the value of your dining room chairs is by researching similar items that have recently sold at thrift stores or online marketplaces. Another option is to consult with a tax professional who can help you accurately assess the value of your donation.

Donating dining room chairs not only benefits those in need, but it can also be a smart financial decision for homeowners. So the next time you're considering getting rid of your old chairs, remember the potential tax benefits and consider donating them instead.

To ensure that you receive the maximum tax deduction for your donation, it is important to properly value your dining room chairs. The IRS has specific guidelines for determining the fair market value of donated items, which takes into account factors such as the condition of the chairs, the original purchase price, and the current market value.

One way to determine the value of your dining room chairs is by researching similar items that have recently sold at thrift stores or online marketplaces. Another option is to consult with a tax professional who can help you accurately assess the value of your donation.

Donating dining room chairs not only benefits those in need, but it can also be a smart financial decision for homeowners. So the next time you're considering getting rid of your old chairs, remember the potential tax benefits and consider donating them instead.

In Conclusion

In addition to adding beauty and functionality to your dining room, chairs also hold the potential to provide tax savings. By donating your dining room chairs, not only are you giving back to the community, but you may also be able to lower your taxable income and save money on taxes. So why not make a positive impact and donate your chairs today?

In addition to adding beauty and functionality to your dining room, chairs also hold the potential to provide tax savings. By donating your dining room chairs, not only are you giving back to the community, but you may also be able to lower your taxable income and save money on taxes. So why not make a positive impact and donate your chairs today?