If you're in the market for a new mattress, you may be wondering if you can deduct the cost on your taxes. Unfortunately, the answer is not a simple yes or no. While there are some situations where a mattress may be tax deductible, it's important to understand the rules and regulations set by the IRS. Let's dive into the details to see if you can claim a mattress on your taxes.Can you deduct a mattress on your taxes?

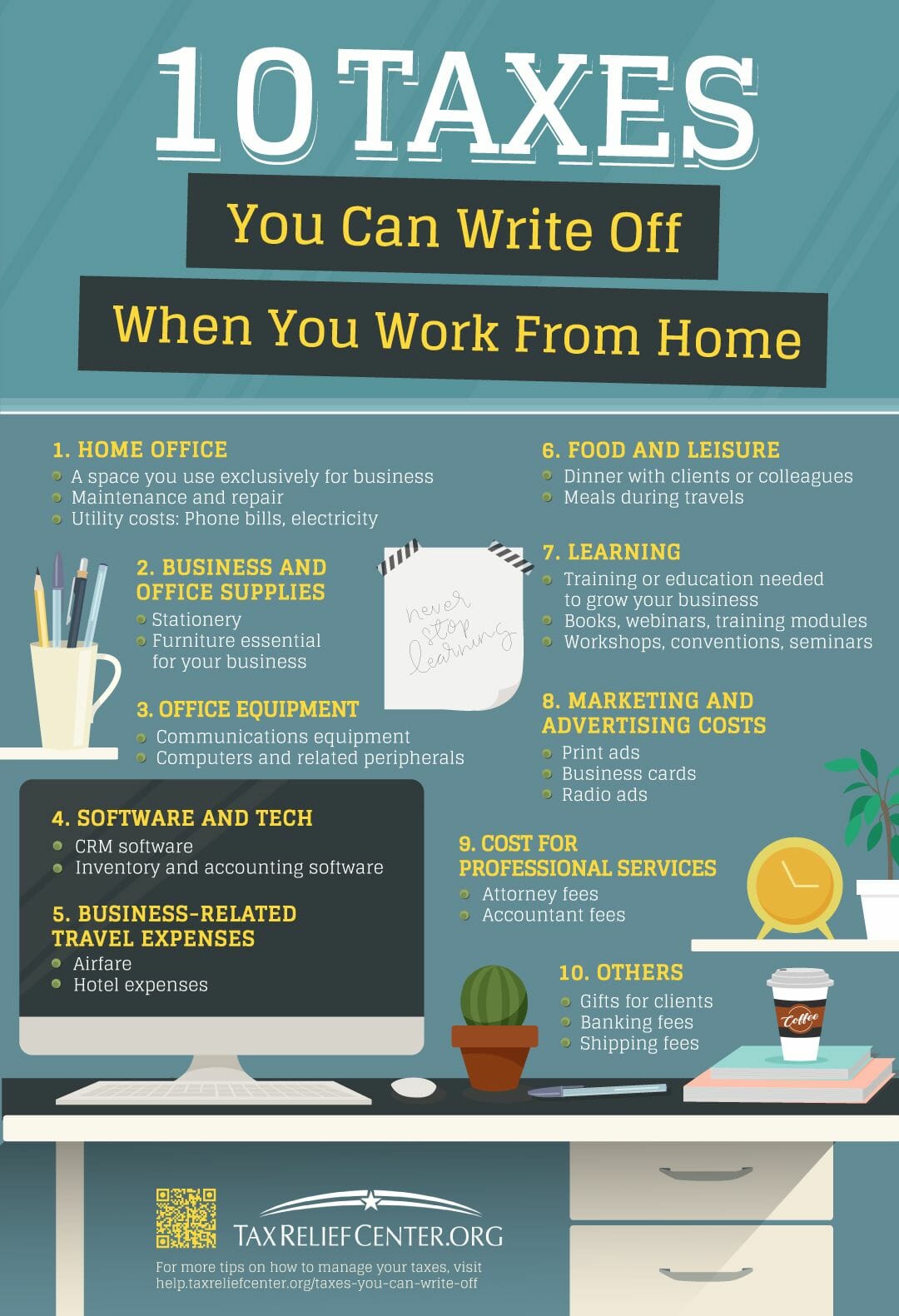

The short answer is, it depends. The IRS allows for deductions on certain home expenses, but a mattress may not always fall under this category. For example, if you have a home office and use your mattress as a place to work, you may be able to deduct a portion of the cost. However, if the mattress is solely used for personal use, it would not be considered a deductible expense.Can you write off a mattress on your taxes?

As mentioned, the IRS allows for deductions on certain home expenses, but mattresses are not specifically listed as a deductible item. However, if you can prove that the mattress is necessary for your work or business, you may be able to claim it as a deductible expense. This would require detailed documentation and proof of the necessity of the mattress.Are mattresses tax deductible?

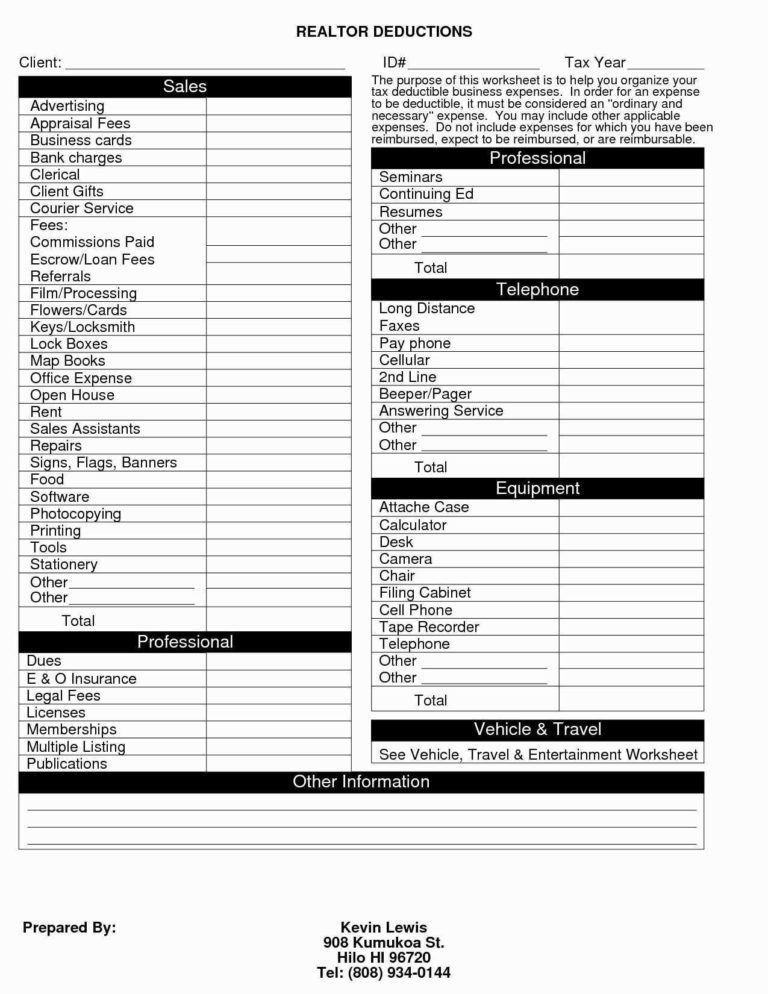

If you are self-employed and use your mattress for work purposes, you may be able to claim a portion of the cost as a business expense. This would require keeping detailed records and being able to justify why the mattress is necessary for your work. It's important to consult with a tax professional to ensure you are following all necessary regulations and claiming the expense correctly.Can you claim a mattress on your taxes?

In most cases, a mattress would not be considered a tax deduction. However, if you have a home office and use your mattress for work purposes, it may fall under the category of a business expense. This would require meeting certain criteria set by the IRS and having proper documentation to support the claim.Is a mattress considered a tax deduction?

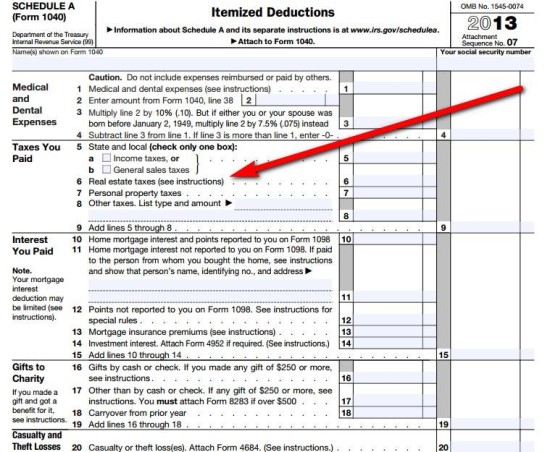

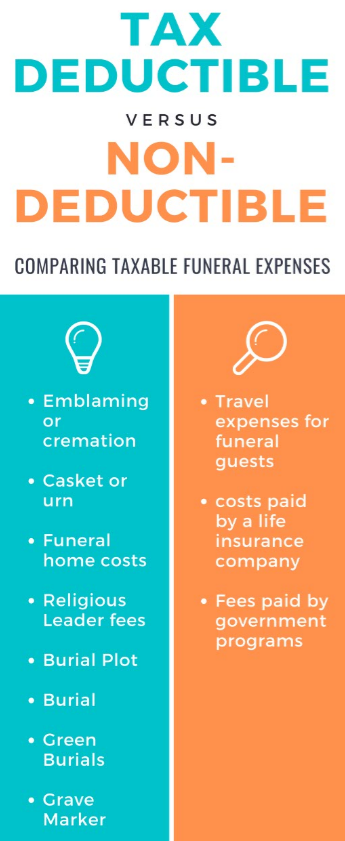

There are several home expenses that may be tax deductible, including mortgage interest, property taxes, and certain home improvements. As mentioned, if you have a home office, you may also be able to deduct expenses related to that space. It's important to consult with a tax professional to determine which expenses you may be able to claim on your taxes.What home expenses are tax deductible?

Similar to mattresses, furniture is not specifically listed as a deductible expense on taxes. However, if you can prove that the furniture is necessary for your work or business, you may be able to claim it as a business expense. This would require keeping detailed records and following all IRS regulations.Can you deduct furniture on your taxes?

Aside from home expenses, there are several other items that may be tax deductible. These can include charitable donations, medical expenses, and certain work-related expenses. It's important to keep detailed records and consult with a tax professional to ensure you are claiming the appropriate deductions on your taxes.What can you write off on your taxes?

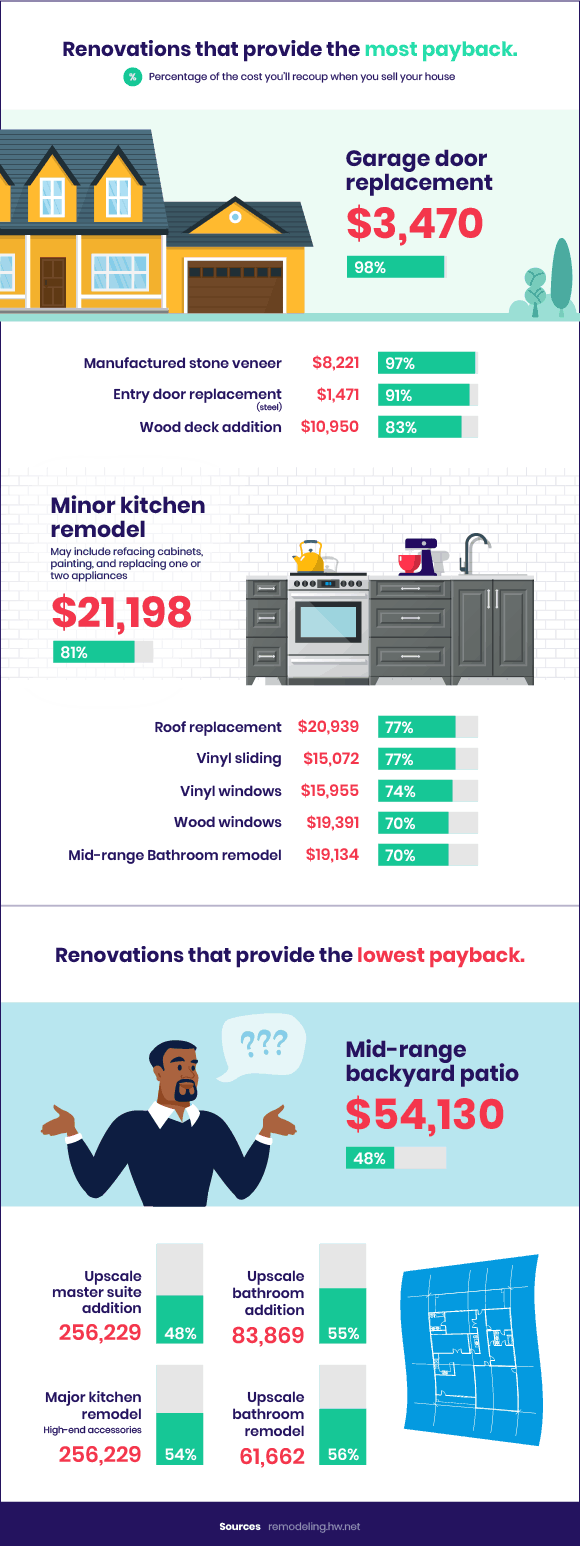

In some cases, home improvements may be tax deductible. This typically applies to improvements made for medical reasons or to make a home more energy-efficient. It's important to keep all receipts and documentation to support the claim and consult with a tax professional to ensure you are following the necessary regulations.Are home improvements tax deductible?

As mentioned, if you can prove that the mattress is necessary for your work or business, you may be able to claim it as a business expense. This would require meeting certain criteria set by the IRS and having proper documentation to support the claim. It's always best to consult with a tax professional to ensure you are claiming the expense correctly.Can you claim a new mattress on your taxes?

Can You Deduct a Mattress for Your House Design? Exploring Tax Deductions for Home Improvements

The Importance of a Good Mattress in House Design

When it comes to designing your dream home, choosing the right

mattress

may not be at the top of your list. However, it's important to remember that a comfortable and supportive

mattress

can greatly impact your overall health and well-being. With adequate sleep being crucial for our physical and mental health, a good

mattress

is essential for a happy and functional home.

When it comes to designing your dream home, choosing the right

mattress

may not be at the top of your list. However, it's important to remember that a comfortable and supportive

mattress

can greatly impact your overall health and well-being. With adequate sleep being crucial for our physical and mental health, a good

mattress

is essential for a happy and functional home.

Understanding Tax Deductions for Home Improvements

If you're planning on making improvements to your house design, such as purchasing a new

mattress

, you may be wondering if you can deduct the cost from your taxes. The answer is, it depends. While most home improvements are not tax-deductible, there are certain situations where you may be able to claim a deduction.

If you're planning on making improvements to your house design, such as purchasing a new

mattress

, you may be wondering if you can deduct the cost from your taxes. The answer is, it depends. While most home improvements are not tax-deductible, there are certain situations where you may be able to claim a deduction.

When Can You Deduct a Mattress for Your House Design?

In general, home improvements that increase the value of your property, such as a new roof or a kitchen remodel, are not eligible for tax deductions. However, if you are making improvements for medical reasons, such as installing a wheelchair ramp or adding features for a disabled family member, you may be able to claim a tax deduction. This includes purchasing a special

mattress

for someone with a medical condition that requires specific support.

In general, home improvements that increase the value of your property, such as a new roof or a kitchen remodel, are not eligible for tax deductions. However, if you are making improvements for medical reasons, such as installing a wheelchair ramp or adding features for a disabled family member, you may be able to claim a tax deduction. This includes purchasing a special

mattress

for someone with a medical condition that requires specific support.

Documenting Your Mattress Purchase for Tax Purposes

If you believe you qualify for a tax deduction for your

mattress

purchase, it's important to keep detailed records. This includes keeping receipts and any documentation from your doctor stating the medical necessity for the

mattress

. You may also want to consult with a tax professional to ensure you are following all necessary guidelines for claiming deductions.

If you believe you qualify for a tax deduction for your

mattress

purchase, it's important to keep detailed records. This includes keeping receipts and any documentation from your doctor stating the medical necessity for the

mattress

. You may also want to consult with a tax professional to ensure you are following all necessary guidelines for claiming deductions.

Invest in Your House Design and Your Health

While you may not be able to deduct the cost of a

mattress

for your house design in most cases, it's important to prioritize your health and well-being when creating your dream home. A high-quality

mattress

can not only improve your sleep and overall health, but also add value to your property. And who knows, with the constantly changing tax laws, perhaps one day

mattress

deductions for home improvements will become a reality.

While you may not be able to deduct the cost of a

mattress

for your house design in most cases, it's important to prioritize your health and well-being when creating your dream home. A high-quality

mattress

can not only improve your sleep and overall health, but also add value to your property. And who knows, with the constantly changing tax laws, perhaps one day

mattress

deductions for home improvements will become a reality.