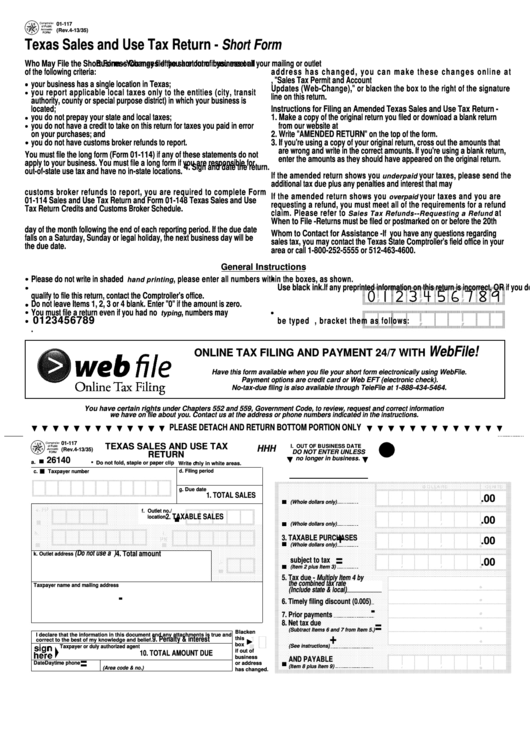

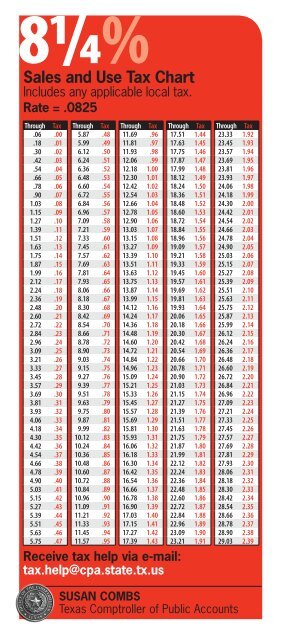

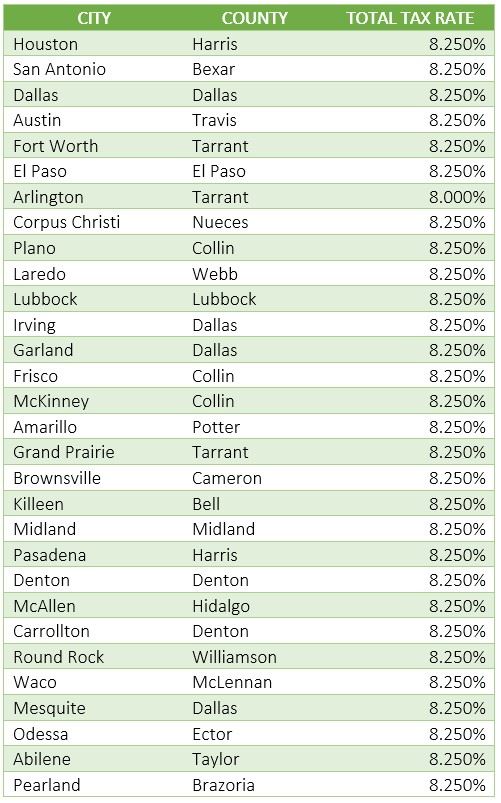

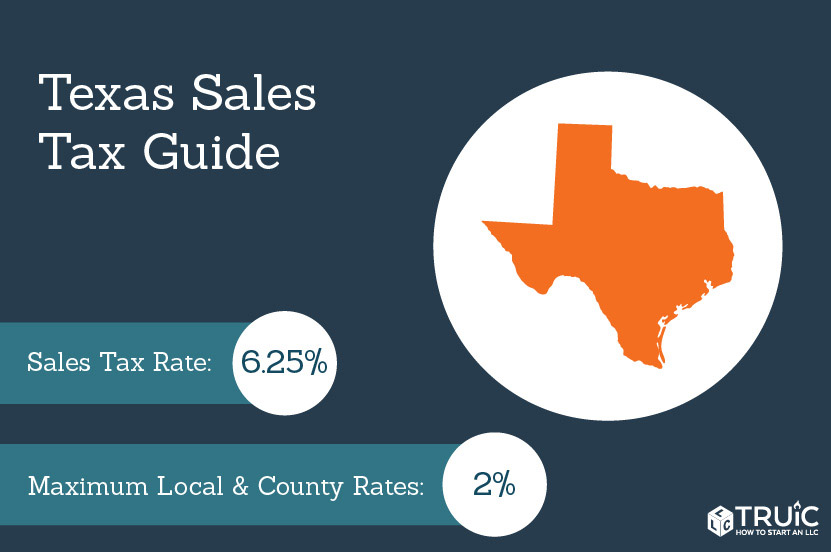

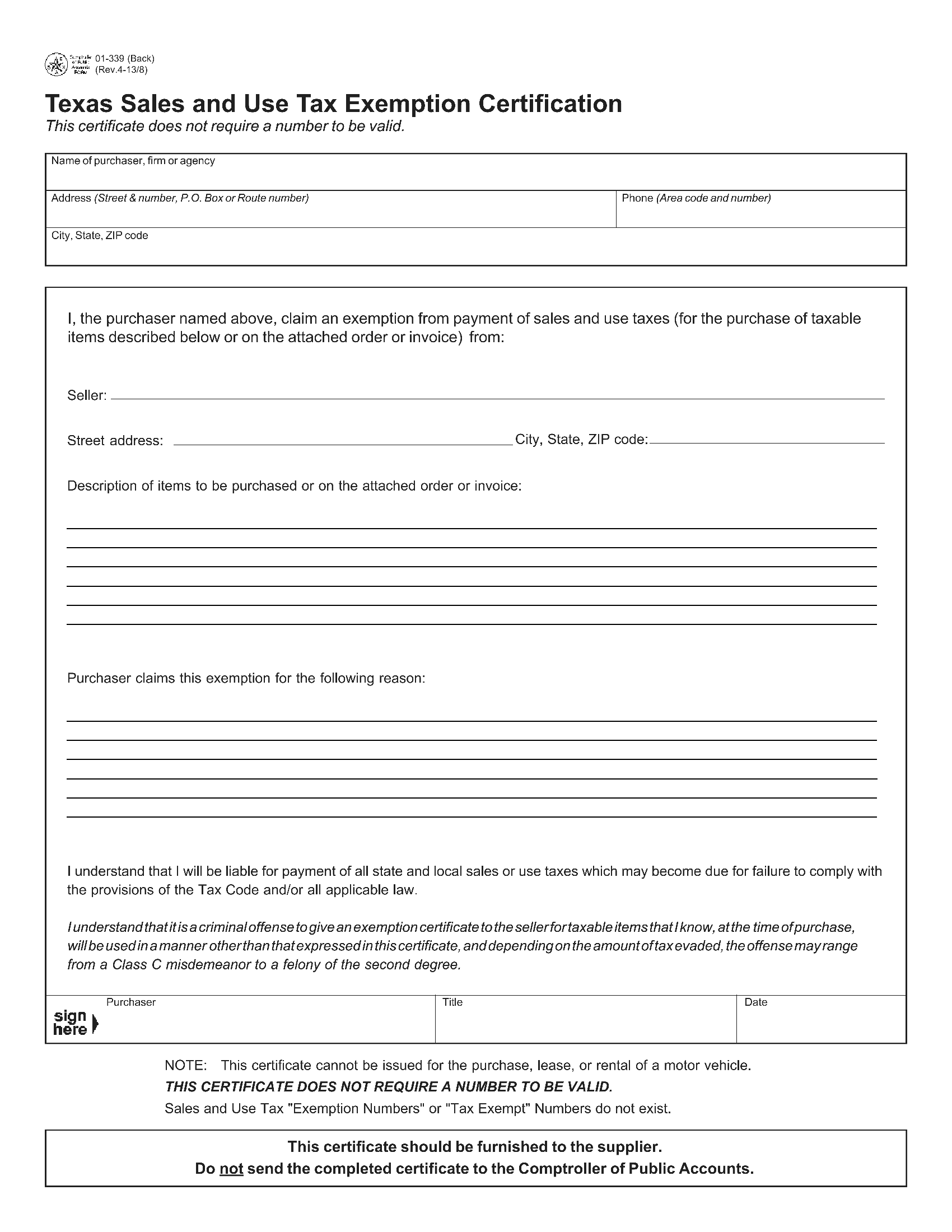

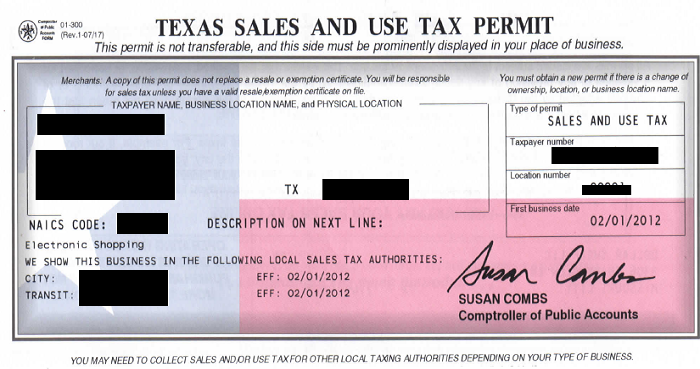

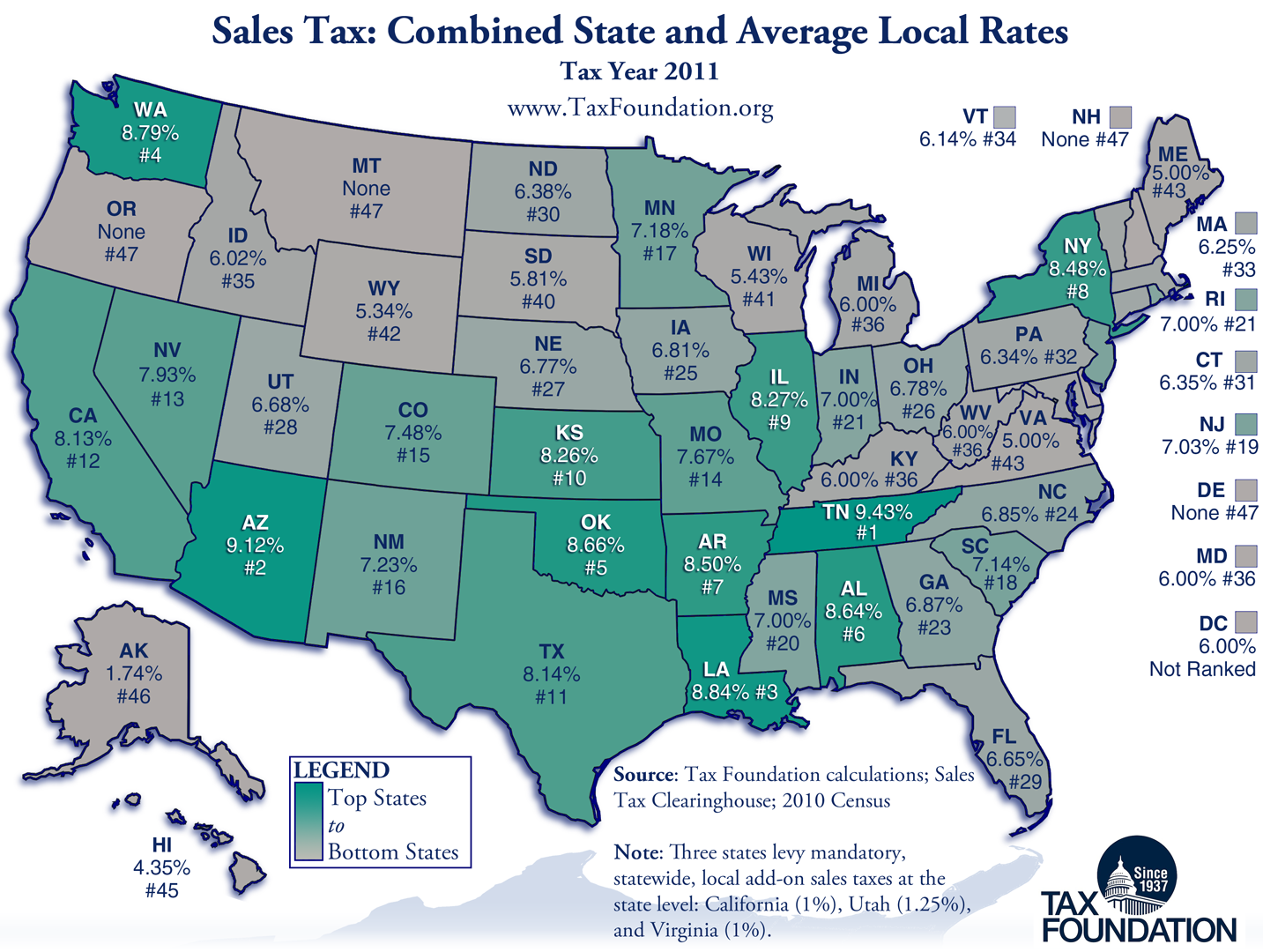

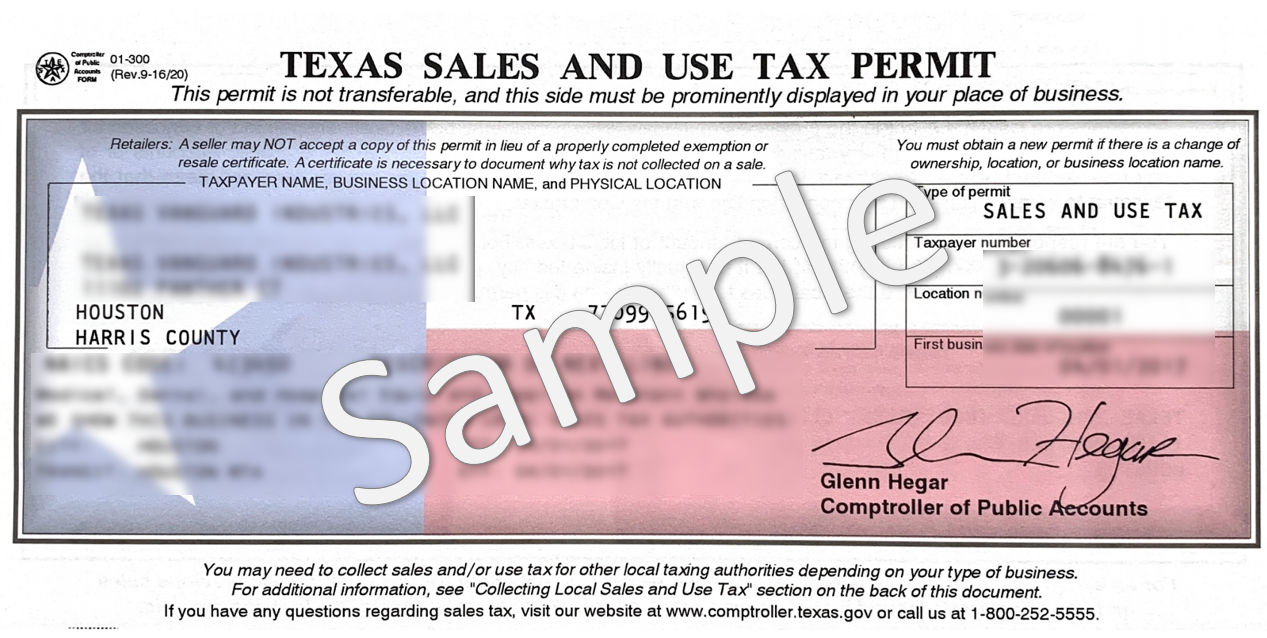

Texas has a state sales tax of 6.25% on all retail sales of tangible personal property, including mattresses. However, there is an exemption for prescription mattresses, which are considered medical equipment. This means that if you have a valid prescription for a mattress, you may be able to avoid paying sales tax on your purchase.Prescription Mattress Sales Tax in Texas

The prescription mattress sales tax exemption in Texas is meant to provide financial relief for individuals who require a specialized mattress for medical reasons. This exemption is in place to ensure that those with medical needs are not burdened with additional costs when purchasing necessary equipment.Prescription Mattress Sales Tax Exemption in Texas

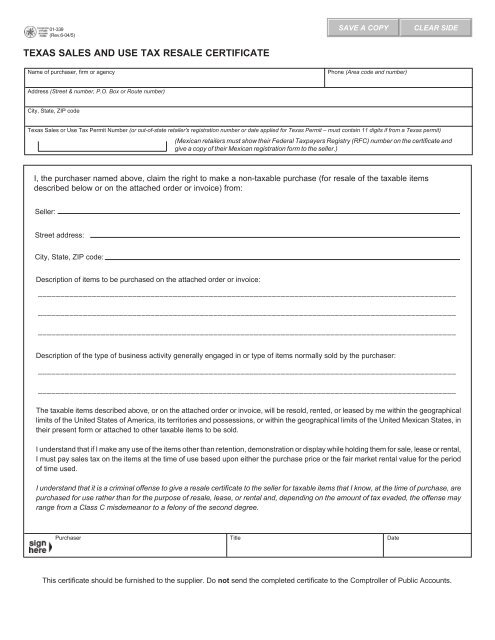

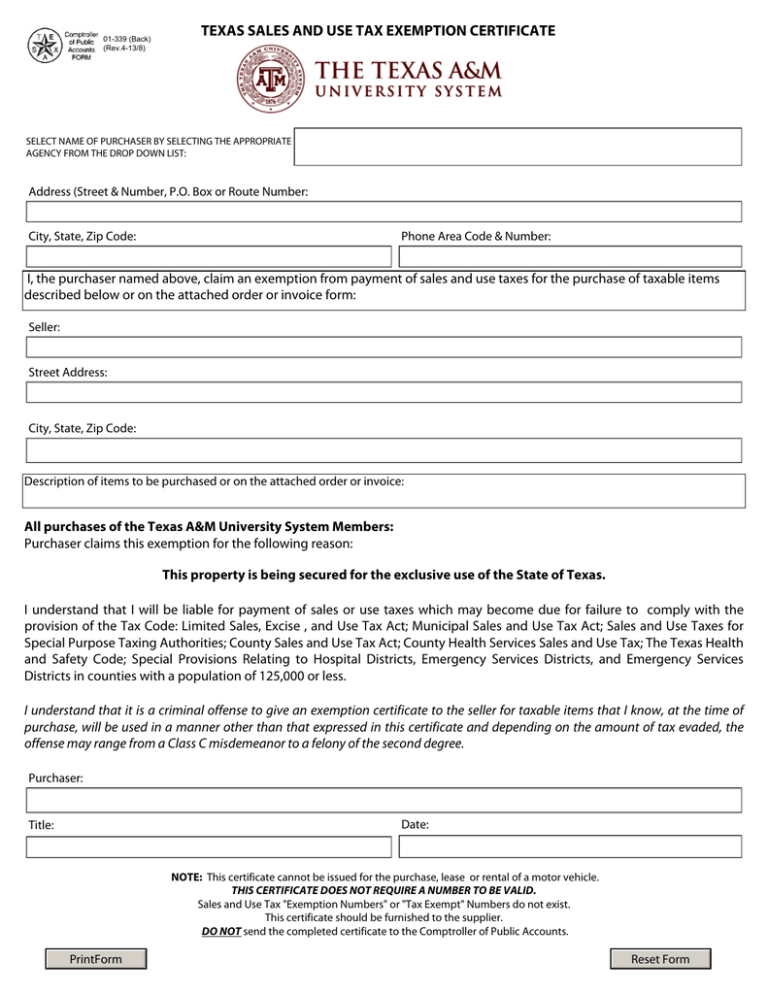

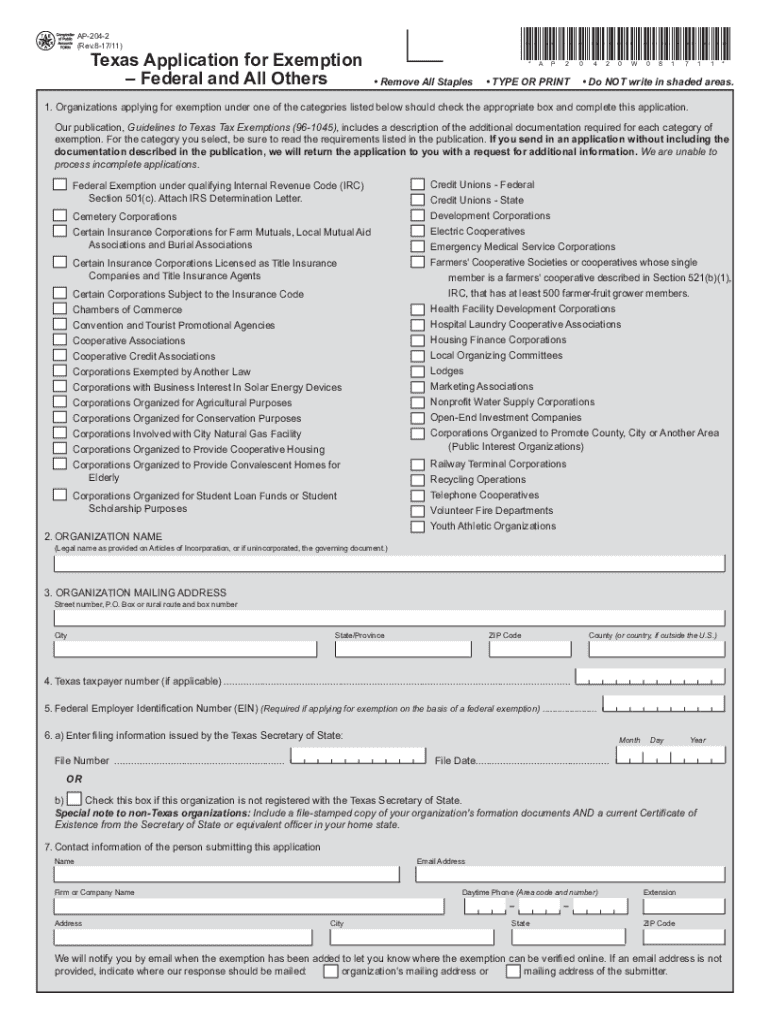

While mattresses are generally subject to sales tax in Texas, there are certain exemptions that may apply. For example, mattresses sold as part of a bundled package with a bed frame or other furniture may be exempt from sales tax if the total price of the package is less than $5,000. Additionally, mattresses sold to the federal government or to certain nonprofit organizations may also be exempt from sales tax.Texas Sales Tax on Mattresses

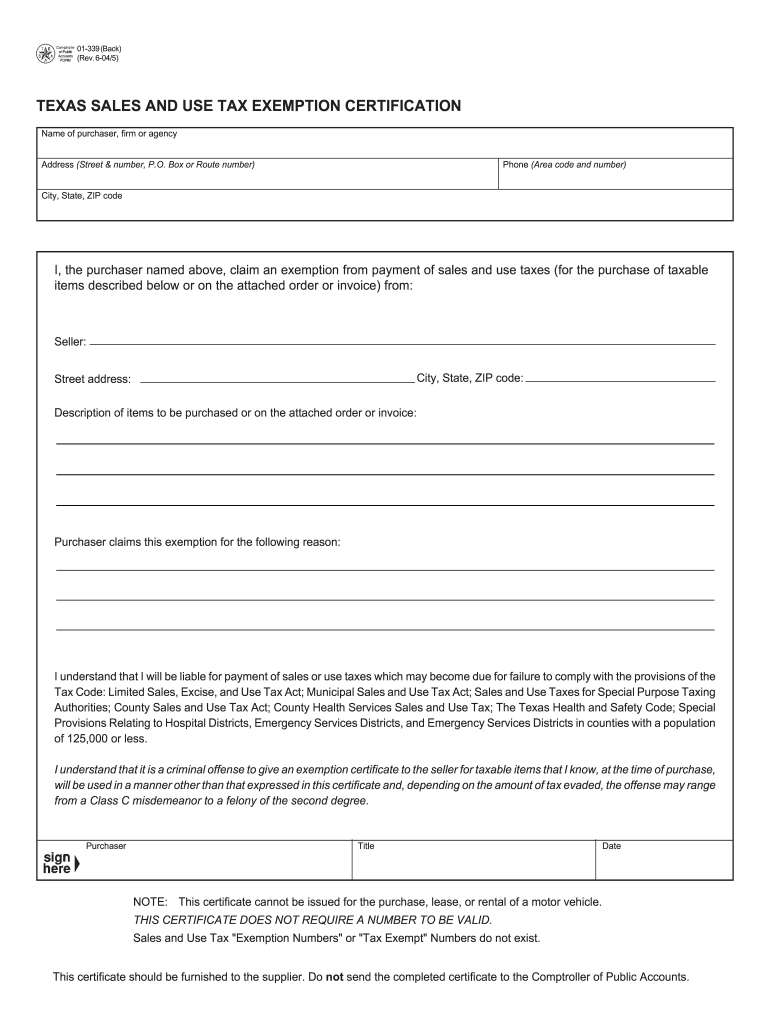

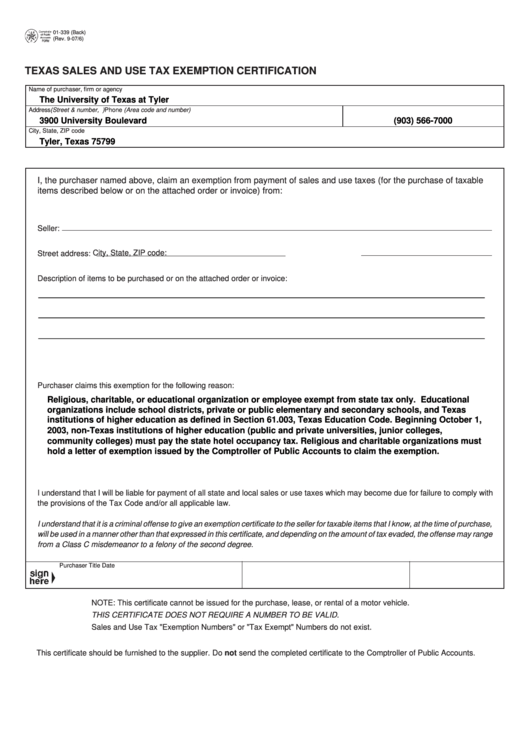

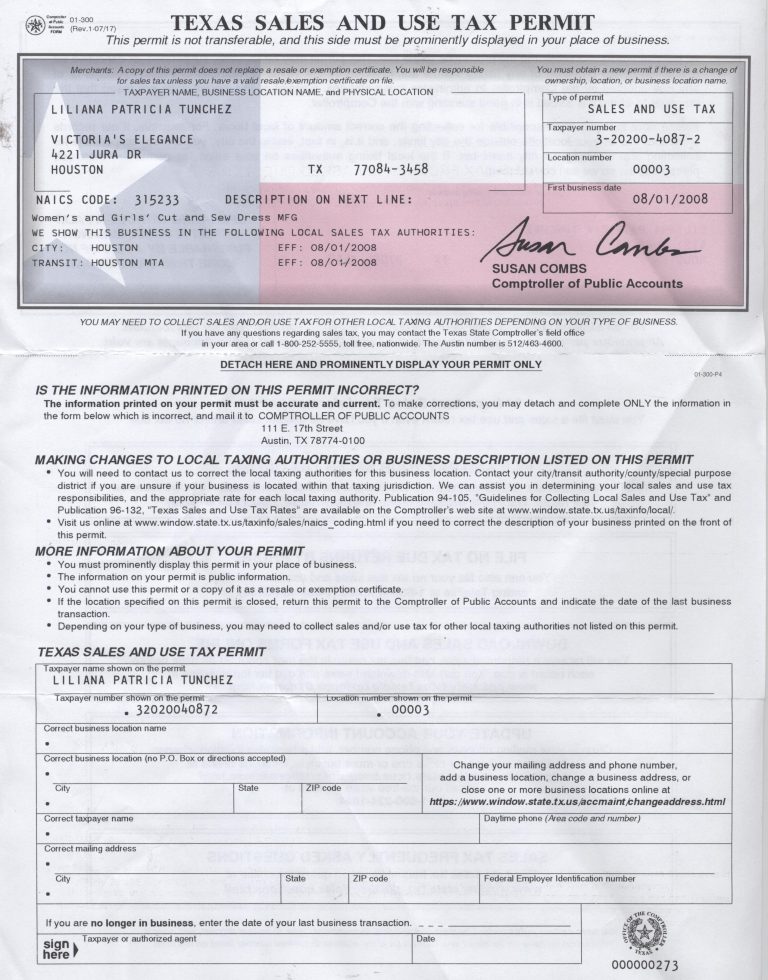

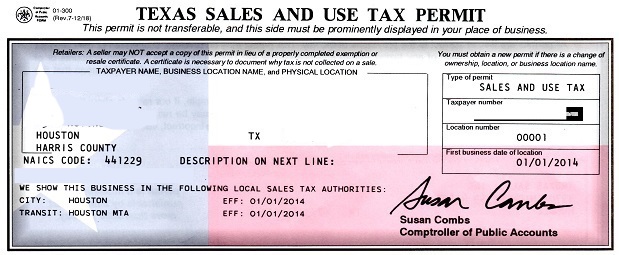

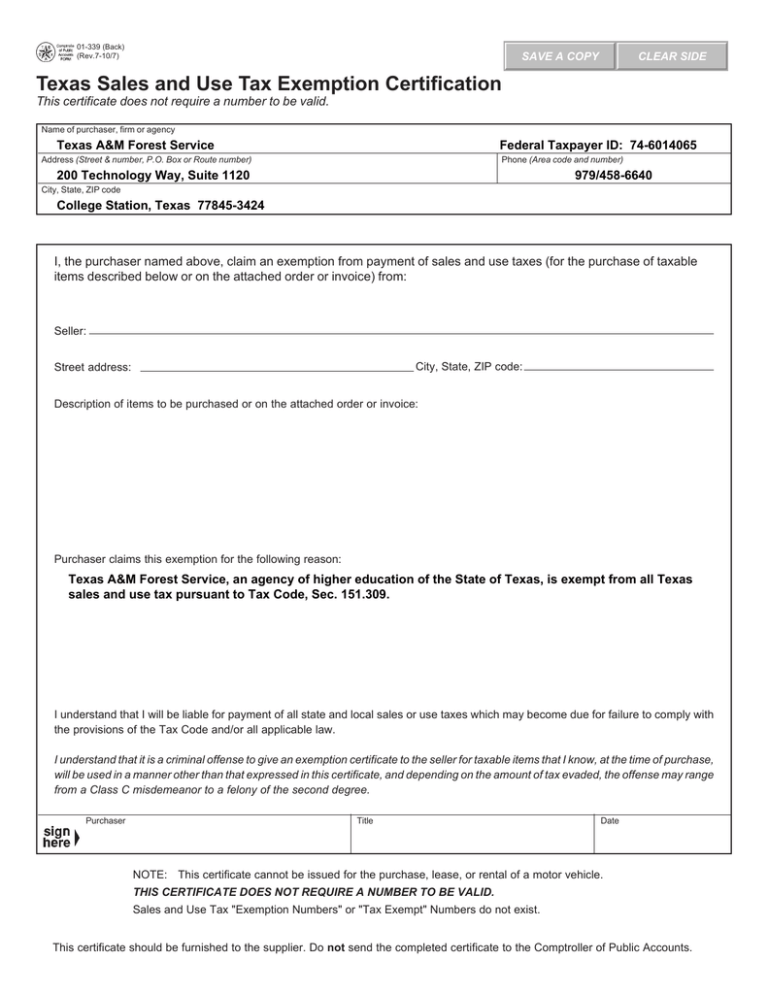

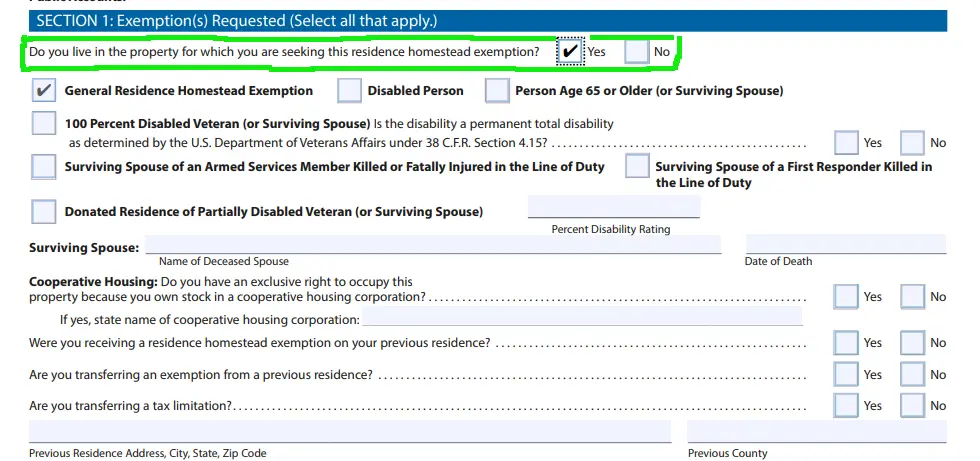

The prescription mattress tax exemption in Texas falls under the category of medical equipment and supplies. This means that in order to qualify for the exemption, you must have a valid prescription from a licensed healthcare professional. The prescription must specifically state that a mattress is medically necessary for the treatment of a particular condition.Prescription Mattress Tax Exemption in Texas

In addition to prescription mattresses, there is a sales tax exemption in Texas for other types of medical equipment. This includes items such as wheelchairs, walkers, and hospital beds. The exemption also applies to certain medical supplies, such as oxygen tanks and diabetic testing supplies.Texas Sales Tax Exemption for Medical Equipment

For individuals who do not have a valid prescription for a mattress, the sales tax rate in Texas is 6.25%. This means that if you are purchasing a mattress for non-medical reasons, you will be required to pay sales tax on your purchase. However, with a valid prescription, you may be able to avoid this extra cost.Prescription Mattress Tax in Texas

The state of Texas offers a sales tax exemption for a variety of prescription items, including medications, eyeglasses, and medical devices. This is meant to help relieve the financial burden for individuals who require these items for medical reasons. To qualify for the exemption, you must have a valid prescription from a licensed healthcare professional.Texas Sales Tax Exemption for Prescription Items

It is important to note that the prescription mattress tax exemption in Texas only applies to mattresses that are specifically prescribed for medical reasons. This means that if you are purchasing a mattress for general use, you will still be required to pay sales tax on your purchase. However, if you have a valid prescription, you may be able to save some money on your new mattress.Prescription Mattress Tax Exemption in Texas

In addition to medical equipment and prescription items, there is also a sales tax exemption in Texas for certain medical supplies. This includes items such as bandages, hearing aids, and prosthetic devices. Like with other exemptions, a valid prescription is required to qualify for this exemption.Texas Sales Tax Exemption for Medical Supplies

In summary, the state of Texas offers a sales tax exemption for prescription mattresses, as well as other medical equipment and supplies. This is meant to assist individuals with medical needs in obtaining necessary items without the added burden of sales tax. If you have a valid prescription for a mattress, be sure to take advantage of this exemption when making your purchase.Prescription Mattress Tax in Texas

The Benefits of Investing in a Prescription Mattress in Texas

Why Prescription Mattresses are Becoming Popular in Texas

In recent years, there has been a growing trend in Texas for individuals to invest in prescription mattresses. These specialized mattresses are designed to provide customized support and comfort based on a person's specific body type, sleeping habits, and health conditions. This tailored approach to sleep has been gaining popularity due to the numerous benefits it offers to individuals looking for a better night's rest.

In recent years, there has been a growing trend in Texas for individuals to invest in prescription mattresses. These specialized mattresses are designed to provide customized support and comfort based on a person's specific body type, sleeping habits, and health conditions. This tailored approach to sleep has been gaining popularity due to the numerous benefits it offers to individuals looking for a better night's rest.

Improved Sleep Quality and Health Benefits

One of the main reasons why prescription mattresses are becoming increasingly popular in Texas is because they offer improved sleep quality and numerous health benefits. These mattresses are designed to provide proper spinal alignment, reducing back and neck pain. They also offer pressure relief for sensitive areas of the body, such as the shoulders and hips, promoting better blood circulation and reducing the risk of pressure ulcers.

Furthermore, prescription mattresses can also help with conditions such as sleep apnea, acid reflux, and allergies. By providing proper support and reducing allergens, these mattresses can improve the overall quality of sleep and alleviate symptoms of these conditions.

One of the main reasons why prescription mattresses are becoming increasingly popular in Texas is because they offer improved sleep quality and numerous health benefits. These mattresses are designed to provide proper spinal alignment, reducing back and neck pain. They also offer pressure relief for sensitive areas of the body, such as the shoulders and hips, promoting better blood circulation and reducing the risk of pressure ulcers.

Furthermore, prescription mattresses can also help with conditions such as sleep apnea, acid reflux, and allergies. By providing proper support and reducing allergens, these mattresses can improve the overall quality of sleep and alleviate symptoms of these conditions.

Cost-Effective Solution for Better Sleep

While prescription mattresses may have a higher upfront cost, they are a cost-effective solution in the long run. These mattresses are designed to last for several years, providing consistent support and comfort. This can save individuals money on frequent mattress replacements.

Moreover, investing in a prescription mattress can also save individuals money on healthcare costs. By promoting better sleep and improving overall health, individuals may see a decrease in medical expenses related to conditions such as back pain and allergies.

In conclusion,

while there may be a sales tax on prescription mattresses in Texas, the benefits of investing in one far outweigh the cost. These specialized mattresses provide tailored support and comfort, leading to improved sleep quality and numerous health benefits. So if you're looking for a long-term solution for better sleep, consider investing in a prescription mattress today.

While prescription mattresses may have a higher upfront cost, they are a cost-effective solution in the long run. These mattresses are designed to last for several years, providing consistent support and comfort. This can save individuals money on frequent mattress replacements.

Moreover, investing in a prescription mattress can also save individuals money on healthcare costs. By promoting better sleep and improving overall health, individuals may see a decrease in medical expenses related to conditions such as back pain and allergies.

In conclusion,

while there may be a sales tax on prescription mattresses in Texas, the benefits of investing in one far outweigh the cost. These specialized mattresses provide tailored support and comfort, leading to improved sleep quality and numerous health benefits. So if you're looking for a long-term solution for better sleep, consider investing in a prescription mattress today.